st-pol.ru

Tools

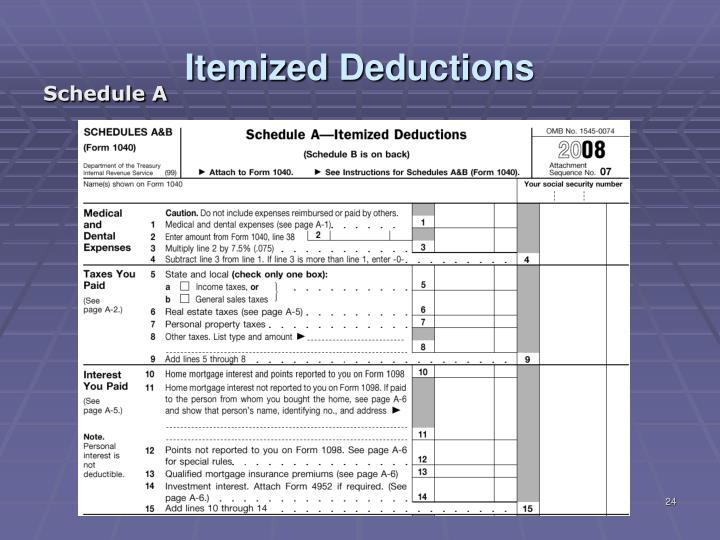

Schedule A Deductions List

The same region codes used in reporting income are used in Schedule A to claim deductions of nontaxable or exempt income. deduction code list. City. There is no tax schedule for Mississippi income taxes. The graduated income tax rate is: 0% on the first $10, of taxable income.; 5% on the remaining. Eligible deductions may include qualified medical expenses, state and local taxes, mortgage interest, sales tax payments, and some charitable contributions. Who. This form is used to calculate itemized deductions. Taxpayers typically can deduct either their itemized deductions or their standard deduction from their. schedule with your List type and amount. Important! Don't include employee business expenses, tax preparation fees, or other deductions subject to the. The Ohio Schedule of Adjustments contains additions and deductions that must be made to federal adjusted gross income to calculate Ohio adjusted gross income. Itemized deductions include medical expenses, mortgage interest, and charitable donations. Standard vs. Itemized Deductions. The Tax Cuts and Jobs Act (TCJA). Did you file a Schedule A, B, D, E, F, or H with your IRS Form ? · Schedule A—Itemized Deductions · Schedule B—Interest and Ordinary Dividends · Schedule. Itemize Deductions · 1. Unreimbursed Medical and Dental Expenses · 2. Long-term Care Insurance Premiums · 3. Taxes You Paid · 4. Interest You Paid · 5. Charity. The same region codes used in reporting income are used in Schedule A to claim deductions of nontaxable or exempt income. deduction code list. City. There is no tax schedule for Mississippi income taxes. The graduated income tax rate is: 0% on the first $10, of taxable income.; 5% on the remaining. Eligible deductions may include qualified medical expenses, state and local taxes, mortgage interest, sales tax payments, and some charitable contributions. Who. This form is used to calculate itemized deductions. Taxpayers typically can deduct either their itemized deductions or their standard deduction from their. schedule with your List type and amount. Important! Don't include employee business expenses, tax preparation fees, or other deductions subject to the. The Ohio Schedule of Adjustments contains additions and deductions that must be made to federal adjusted gross income to calculate Ohio adjusted gross income. Itemized deductions include medical expenses, mortgage interest, and charitable donations. Standard vs. Itemized Deductions. The Tax Cuts and Jobs Act (TCJA). Did you file a Schedule A, B, D, E, F, or H with your IRS Form ? · Schedule A—Itemized Deductions · Schedule B—Interest and Ordinary Dividends · Schedule. Itemize Deductions · 1. Unreimbursed Medical and Dental Expenses · 2. Long-term Care Insurance Premiums · 3. Taxes You Paid · 4. Interest You Paid · 5. Charity.

Unreimbursed business expenses reportable on PA Schedule UE. Miscellaneous The request to pass through credit must separately list Jim's and Jane's. State and local taxes; Home mortgage interest deduction; Casualty and theft losses; Some charitable contributions. Deductions eliminated in that were not. List type and amount. 8z. Page 3. Schedule CA () Complete the Itemized Deductions Worksheet in the instructions for Schedule CA (), line Claim these deductions from taxable income on Schedule A. Usually, these three basic categories fall under the 2% rule: Employee business expenses; Tax-related. Per IRS Instructions for Schedule A Itemized Deductions, page A Other Itemized Deductions. List the type and amount of each expense from the following list. Supported federal forms · IRA deduction · Investment expenses (Schedule A) · Margin loan interest (Form ) · Series EE or Series I U.S. savings bond interest. If you choose to itemize deductions on Schedule A, you deduct cash and non-cash charitable donations of up to 50% and 30%, respectively, of your adjusted gross. deductions from federal Schedule A. Other Deductions. Child and Dependent Care Expenses. You may qualify to claim this deduction if: You were eligible to. If claiming Arizona itemized deductions, individuals must complete and include Federal Form , Schedule A, and, if applicable, an Arizona Schedule A with an. Delinquent Taxpayers Lists · Refund Toggle submenu. Check Refund Status If the return is filed on paper, the total from the Deductions schedule must. If you itemize, we'll automatically fill out Schedule A, Itemized st-pol.ru checklist. Social & Customer Reviews. Social & Customer Reviews. Anyone who pays property taxes on their principal place of residence in Indiana. Additional Forms. Schedule 2, Schedule C. Small Employer Health Insurance. Additions/Subtractions · unemployment compensation. · gambling losses. · your federal itemized deductions from U.S. Schedule A, Itemized Deductions. · any. applicable) list 26 Tax preparation fees PART II—ITEMIZED DEDUCTIONS LIMITATION SCHEDULE. Use this schedule if the. If you did not file federal Schedule A, enter the total of your medical and dental expenses after you reduce these expenses by any payments received by you from. If you deduct NC itemized deductions, you must include Form D Schedule A with Form D Qualified Mortgage Interest and Real Estate Property Taxes. The. Do not include on Schedule A items deducted elsewhere, such as If you claimed a deduction for foreign income taxes on Line 6, list the amount and fill. A fiduciary may distribute the tax credit to its beneficiaries using Maryland Schedule K-1(). A list of expenses that are "qualified capital expenses" is. The above lists are not exhaustive. IRS Publication , Med- ical and Dental Expenses, describes the types of expenses you can and can't deduct in greater. The federal income tax allowable as a deduction is the net tax liability as accrued and subsequently paid, that is, the amount after subtracting all deductible.

Top Rated Debt Management Companies

:max_bytes(150000):strip_icc()/nycif1otjj27wl8eptsh-224e311d36564c8e8b86dbfe863a95a9.jpeg)

The Top Debt Management Companies · Money Management International · GreenPath Financial Wellness · Consolidated Credit Counseling · Cambridge Credit Counseling. We have helped more than 2 million people nationwide transform their financial outlooks through credit counseling, debt management, student loan counseling. Best companies offering debt management plans · Accredited Debt Relief: Best for fast payoff. · Money Management International: Best for low fees. · GreenPath. I was also looking for a company that would include best egg as this bill is my largest besides my mortgage. I was also able to include all of. 4 Pillars Financial Wellness Advocates · Consolidated Credit Counseling Services of Canada Inc. · Farber Debt Solutions · Pierre Roy & Associés · Sands & Associates. Debt management companies and credit counselors can help you reduce or Top. ×. How to recognize an official Oregon st-pol.ru Official websites use. Compare the best debt relief companies. We evaluated plans, fees, customer satisfaction, and trust ratings to find the most reputable debt relief options to. Debt consolidation is an effective financial strategy for eliminating credit card debt. It reduces your interest rate and monthly payment so you pay off debts. Who Are the Best Debt Management Companies? · InCharge Debt Solutions Logo 1. · Money Management International MMI Logo 2. · Greenpath Logo 3. · Consolidated. The Top Debt Management Companies · Money Management International · GreenPath Financial Wellness · Consolidated Credit Counseling · Cambridge Credit Counseling. We have helped more than 2 million people nationwide transform their financial outlooks through credit counseling, debt management, student loan counseling. Best companies offering debt management plans · Accredited Debt Relief: Best for fast payoff. · Money Management International: Best for low fees. · GreenPath. I was also looking for a company that would include best egg as this bill is my largest besides my mortgage. I was also able to include all of. 4 Pillars Financial Wellness Advocates · Consolidated Credit Counseling Services of Canada Inc. · Farber Debt Solutions · Pierre Roy & Associés · Sands & Associates. Debt management companies and credit counselors can help you reduce or Top. ×. How to recognize an official Oregon st-pol.ru Official websites use. Compare the best debt relief companies. We evaluated plans, fees, customer satisfaction, and trust ratings to find the most reputable debt relief options to. Debt consolidation is an effective financial strategy for eliminating credit card debt. It reduces your interest rate and monthly payment so you pay off debts. Who Are the Best Debt Management Companies? · InCharge Debt Solutions Logo 1. · Money Management International MMI Logo 2. · Greenpath Logo 3. · Consolidated.

Get out of debt with The National Foundation for Credit Counseling, a non-profit trusted network of credit counseling agencies. Connect with a counselor! A reputable credit counseling organization can give you advice on managing your money and debts, help you develop a budget, offer you free educational materials. Credit and Debt Counseling, Debt Consolidation Services, Debt Relief Services BBB Rating: A+. Accredited Business. () Debt management service providers are companies that offer to help a consumer get out of debt quicker through one or more of the following. National Debt Relief is accredited by the American Fair Credit Council (AFCC) and has an A+ rating from the Better Business Bureau. National also has a. The licensed insolvency trustees at Hoyes, Michalos & Associates are debt experts who can help you find the safest and best debt relief solution. TopTenReviews – rated #1 for Debt Settlement; ConsumersAdvocate – rated #1 for Debt Settlement; ConsumerAffairs – rated #1 for Debt Settlement; 46, reviews. We help consumers create, restore, and maintain a life of financial wellness. Our nonprofit programs are designed to educate, motivate, and liberate. Ready to start saving with a nonprofit debt management plan? MMI is one of the nation's largest and most-trusted DMP providers and works with you to develop a. With the Debt Management Program from the national nonprofit GreenPath Financial Wellness, you become debt free faster. We put 60 years of trusted experience. A closer look at our top debt relief companies ; National Debt Relief: Best overall debt relief company. National Debt Relief. Rating: stars out of 5. Any company accredited by the NFCC (national foundation for credit counseling). I use Money Management International which was recommended to me by Bank of. LightStream is our pick for the best debt consolidation loan based on an industry-leading score of 5 out of 5 stars in our latest review. Our credit counseling and debt consolidation services can help you gain control of your financial situation. We are a nonprofit credit counseling organization. If you're looking for reputable debt consolidation companies, you can do no better than American Consumer Credit Counseling (ACCC). One of the nation's leading. StepChange Debt Charity is rated. out of 5. Based on ratings given in the Return to top. StepChange logo. Foundation for Credit Counselling, Resolve the client's credit card and payday loan debt for a lesser amount while providing education through consultation. Fort Lauderdale, United States. reputable program, but it can still take several years to complete the program. These programs, which sometimes call themselves “debt settlement” or “debt. Compare the Best Credit Counseling Companies ; Cambridge Credit Counseling Corp, Member of the NFCC and FCAA; HUD-approved housing counseling, Free credit. As a non-profit agency, Trinity provides counseling and debt management services for individuals and families who are experiencing debt problems.

1 2 3 4 5