st-pol.ru

Overview

Mortgage Loans For People With Bankruptcy

You can tap into your home equity after bankruptcy in three ways: a cash-out refinance, a home equity loan or a home equity line of credit. → Cash-out. This waiting period is a minimum that usually ranges from years, depending on the lender, the type of bankruptcy you filed for, and the type of loan you are. The Short Answer is “Yes,” you can get a mortgage while in Bankruptcy. During any bankruptcy, there are a number of hurdles you may encounter when. A Chapter 7 bankruptcy (liquidation) does not disqualify a borrower from obtaining an FHA-insured mortgage if at least two years have elapsed. For private loans, you'll have to wait at least 4 years after your Chapter 7 discharge and at least 2 years after your Chapter 13 discharge, depending on the. Yes, you can get a mortgage after bankruptcy. But it can be more difficult compared to someone with a good credit score. That's because most big banks will. Peoples Bank Mortgage specializes in mortgage after bankruptcy, allowing us to offer Chapter 13 home loans to help you in buying a house after bankruptcy. Not necessarily. The more recent your bankruptcy, the more likely it will prevent you from getting a home loan. However, if certain thresholds of time have. You may still qualify for an FHA loan even if you have bad credit or a bankruptcy. Learn more about the credit score and other requirements for FHA loans. You can tap into your home equity after bankruptcy in three ways: a cash-out refinance, a home equity loan or a home equity line of credit. → Cash-out. This waiting period is a minimum that usually ranges from years, depending on the lender, the type of bankruptcy you filed for, and the type of loan you are. The Short Answer is “Yes,” you can get a mortgage while in Bankruptcy. During any bankruptcy, there are a number of hurdles you may encounter when. A Chapter 7 bankruptcy (liquidation) does not disqualify a borrower from obtaining an FHA-insured mortgage if at least two years have elapsed. For private loans, you'll have to wait at least 4 years after your Chapter 7 discharge and at least 2 years after your Chapter 13 discharge, depending on the. Yes, you can get a mortgage after bankruptcy. But it can be more difficult compared to someone with a good credit score. That's because most big banks will. Peoples Bank Mortgage specializes in mortgage after bankruptcy, allowing us to offer Chapter 13 home loans to help you in buying a house after bankruptcy. Not necessarily. The more recent your bankruptcy, the more likely it will prevent you from getting a home loan. However, if certain thresholds of time have. You may still qualify for an FHA loan even if you have bad credit or a bankruptcy. Learn more about the credit score and other requirements for FHA loans.

Finding the right personal loan after bankruptcy can be challenging but not impossible. So how do you increase your chances of qualifying? With Acorn Finance. Qualifying for Mortgage Loans After Bankruptcy · Conventional Loans- A conventional loan is a mortgage that is not insured or made by a government entity. · FHA. Yes, it's possible to get a personal loan after bankruptcy. It may not be easy, and expect steep interest rates. Since lenders are likely to consider you a. Fannie Mae Loans · Federal Housing Administration (FHA) and Veterans Administration (VA) Loans · USDA Loans · Subprime Lenders. Depending on the financial institution, it can take anywhere from one to four years after your bankruptcy discharge to become eligible to take out a mortgage. A mandated waiting period to apply for a loan. · Rebuilding your credit score. · Shopping for the best mortgage loan available to fit the unique circumstances. If you're someone who went through bankruptcy and/or foreclosure during the housing crisis, you might think you can't get another home loan. Whether you filed a Chapter 7 or a Chapter 13 bankruptcy, the rule of thumb is that you need to wait for two years to get an FHA loan. This type of loan is. Most people qualify for a home mortgage within two to four years after completing Chapter 7 bankruptcy, and possibly sooner after Chapter Technically, a. Mortgage after Bankruptcy or Foreclosure · Buying a home after a bankruptcy, foreclosure or other credit event is possible! · You don't have to wait a couple. Chapter 7 bankruptcies result in a complete discharge of most of the debtor's debt and may be more damaging to a person's credit. According to the standards set. Where to Find a Personal Loan After Bankruptcy ; Avant4, $2, to $35, ; LendingClub6, $1, to $40, ; OneMain Financial7, $1, to $20, ; Upgrade8. Mortgage After Bankruptcy | FHA Mortgages After Chapter 7 Bankruptcy · 2 year minimum waiting period from the time the bankruptcy was discharged · Establish. While it's certainly challenging, it's definitely possible to improve your credit score, save up, and qualify for a home loan once more. Our guide will discuss. Fannie Mae and Freddie Mac (Conventional loans) will not accept mortgage applications from people who filed a chapter 7 bankruptcy until four years after. People in a Chapter 13 Bankruptcy repayment plan can qualify for an FHA and VA loan after making 12 timely payments to the bankruptcy trustee. Chapter As a general rule, if you make 12 on-time monthly payments to the Chapter 13 Trustee, you may well qualify for a home loan (FHA, VA, USDA, and others). Some. If it has been less than two years since your debts were discharged through bankruptcy, then you will need to wait to apply for a mortgage. If you lost your. The waiting period for getting an FHA mortgage after Chapter 13 bankruptcy is two years. It requires permission from the bankruptcy trustee – the person who. After You've Filed for Chapter 13 Bankruptcy · You've paid 12 months of plan payments. · The court approves your request to purchase a house with an FHA loan.

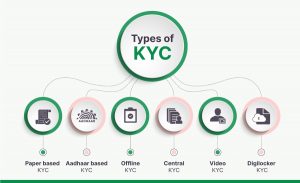

What Is A Kyc Account

These firms must verify customer identities during the opening and ongoing monitoring of accounts. KYC policies require “reasonable due diligence” to know (and. Know Your Customer (KYC) is an umbrella term used for identity verification of customers before developing any business relationship with them. KYC laws were. Know Your Customer (KYC) procedures are used to verify a customer's identity, assess the nature of financial activities and determine if there are money. Copy of certificate of incorporation · Copy of a dated page from the website of the relevant stock exchange · Recent audited accounts · Entry of details held by a. KYC in Banking is the process of identifying and verifying customer identity while opening a bank account and during the course of business. The purpose of KYC. KYC process, and its impacts on every industry Any customer or entity that has a business relationship or maintains an account with the organization. The KYC procedure enables companies to identify and verify the identity of a customer and to ensure that the customer is actually who they say they are. Customer due diligence and KYC are essential to protect the global financial system from money laundering and financing of illegal and criminal activities. During account setup or onboarding processes, organizations use KYC processes to verify that the person signing up is, indeed, who they say they are. These firms must verify customer identities during the opening and ongoing monitoring of accounts. KYC policies require “reasonable due diligence” to know (and. Know Your Customer (KYC) is an umbrella term used for identity verification of customers before developing any business relationship with them. KYC laws were. Know Your Customer (KYC) procedures are used to verify a customer's identity, assess the nature of financial activities and determine if there are money. Copy of certificate of incorporation · Copy of a dated page from the website of the relevant stock exchange · Recent audited accounts · Entry of details held by a. KYC in Banking is the process of identifying and verifying customer identity while opening a bank account and during the course of business. The purpose of KYC. KYC process, and its impacts on every industry Any customer or entity that has a business relationship or maintains an account with the organization. The KYC procedure enables companies to identify and verify the identity of a customer and to ensure that the customer is actually who they say they are. Customer due diligence and KYC are essential to protect the global financial system from money laundering and financing of illegal and criminal activities. During account setup or onboarding processes, organizations use KYC processes to verify that the person signing up is, indeed, who they say they are.

Video KYC. An online Video KYC is another mode through which the customers can quickly complete their KYC for several Accounts. During the process, KYC. A KYC is mandatory as per SEBI guidelines (WEB) to open a trading and demat account. KYC will be verified during the account opening process at Zerodha. To. Confirming the identity of a customer prior to opening account or offering services. This includes both individual and business customers. For businesses. Know Your Customer, or “KYC,” is a legal requirement for financial institutions to verify the identities of people and companies that open financial accounts. KYC, or "Know Your Customer", is a set of processes that allow banks and other financial institutions to confirm the identity of the organisations and. This may involve reviewing account activity, conducting periodic reviews, and updating customer information. Reporting and Recordkeeping: Financial institutions. Know Your Customer (KYC) is a verification process that allows an institution to verify the authenticity of the customer. Know more about the importance and. KYC's full form is Know Your Customer. It is a crucial process ensuring banks identify and verify clients' identities during account opening and periodically. When you open a bank account, apply for a credit card, or take out a loan, the financial institution you do business with will ask you to provide some personal. The Know Your Client (KYC) or Know Your Customer (KYC) is a process to Create a Free AccountCreate a Free Account. Already have an account? Log in. ×. KYC (Know Your Customer) is a crucial process that ensures banks identify and verify clients' identities during account opening and periodically. KYC verification refers to the legal requirement to verify the identify of your customers. This is a mandatory step when opening accounts in many industries. Why Does the Banking Industry Need KYC and AML Compliance? · The types of accounts offered by the bank · The bank's methods of opening accounts · The types of. Easily update your KYC details with ICICI Bank if you're an NRI account holder. Follow simple steps for a hassle-free process. A KYC (Know Your Customer) is helpful for financial institutions to restrict money laundering and financial crimes. Further, the Reserve Bank of India (RBI) has. Know Your Customer (KYC) refers to the process by which banks ensure prospective customers are legitimate both before opening an account, and while conducting. Identity verification: · Customer due diligence: · Ongoing monitoring: ; Account takeover (ATO): · Identity theft: · Synthetic identity: ; Adopt a “data first''. A customer acceptance policy: The criteria for determining whether a customer or client can be accepted to open an account – or if the level of risk requires. KYC Documents Individuals · Individuals (Documents acceptable as proof of identity/address) · Minors · NRIs · Small Accounts. Know your customer (KYC) guidelines and regulations in financial services require professionals to verify the identity, suitability, and risks involved with.

Mrna Technology Stocks

Moderna (NASDAQ: MRNA) · Moderna Return vs. S&P · Moderna Company Info · News & Analysis · Valuation · Podcast Episodes · Earnings Transcripts · Related Stocks · NASDAQ. In , MRNA stock has been one of the US market's best performers. This was due to rising investor enthusiasm over the company's promising Covid vaccine. Moderna Inc. engages in the development of transformative medicines based on messenger ribonucleic acid (mRNA). Moderna (NASDAQ: MRNA) is a biotechnology company known for its mRNA technology, particularly in the development of COVID vaccines. Today, the stock. Tech Stocks · Multiple Quotes Tool · Mortgage Calculator · Economic Calendar engages in the development of transformative medicines based on messenger. Moderna (NASDAQ:MRNA) Stock Quotes, Forecast and News Summary ; Close, $ ; Volume / Avg. M / M ; Day Range, $ - $ ; 52 Wk Range, -. Get Moderna Inc (MRNA.O) real-time stock quotes, news, price and financial information from Reuters to inform your trading and investments. Moderna's mRNA technology gained global recognition with its COVID vaccine, Spikevax®, which was one of the earliest vaccines to receive emergency use. Stock analysis for Moderna Inc (MRNA:NASDAQ GS) including stock price, stock chart, company news, key statistics, fundamentals and company profile. Moderna (NASDAQ: MRNA) · Moderna Return vs. S&P · Moderna Company Info · News & Analysis · Valuation · Podcast Episodes · Earnings Transcripts · Related Stocks · NASDAQ. In , MRNA stock has been one of the US market's best performers. This was due to rising investor enthusiasm over the company's promising Covid vaccine. Moderna Inc. engages in the development of transformative medicines based on messenger ribonucleic acid (mRNA). Moderna (NASDAQ: MRNA) is a biotechnology company known for its mRNA technology, particularly in the development of COVID vaccines. Today, the stock. Tech Stocks · Multiple Quotes Tool · Mortgage Calculator · Economic Calendar engages in the development of transformative medicines based on messenger. Moderna (NASDAQ:MRNA) Stock Quotes, Forecast and News Summary ; Close, $ ; Volume / Avg. M / M ; Day Range, $ - $ ; 52 Wk Range, -. Get Moderna Inc (MRNA.O) real-time stock quotes, news, price and financial information from Reuters to inform your trading and investments. Moderna's mRNA technology gained global recognition with its COVID vaccine, Spikevax®, which was one of the earliest vaccines to receive emergency use. Stock analysis for Moderna Inc (MRNA:NASDAQ GS) including stock price, stock chart, company news, key statistics, fundamentals and company profile.

Investor Relations Overview: Deliver on the promise of mRNA science to create a new generation of transformative medicines for patients. Find the latest historical data for Moderna, Inc. Common Stock (MRNA) at st-pol.ru View historical data in a monthly, bi-annual, or yearly format. Since then, MRNA stock has decreased by % and is now trading at $ View the best growth stocks for here. How were Moderna's earnings last quarter? Check out the latest MODERNA INC. (MRNA) stock quote and chart. View Health Technology, Employees, 5, Fiscal Year-end, 12 / View SEC Filings. View Moderna, Inc. MRNA stock quote prices, financial information, real-time forecasts, and company news from CNN. Moderna Therapeutics Inc (NASDAQ:MRNA) shares shot up more than 13% to News. on 12/14/ What is Moderna Inc(MRNA)'s stock price today? The current price of MRNA is $ The 52 week high of MRNA is $ and 52 week low is $ When is next. Meet Moderna. Moderna's mission is to deliver the greatest possible impact to people through mRNA medicines. Learn more about us. The firm's mRNA technology was rapidly validated with its COVID vaccine, which was authorized in the United States in December Moderna had 44 mRNA. View Moderna, Inc MRNA investment & stock information. Get the latest Moderna, Inc MRNA detailed stock Technology · Zacks Investment Research Home. You are. MRNA is trading at a 66% discount. Price. $ Aug 30, The current price of MRNA is USD — it has decreased by −% in the past 24 hours. Watch Moderna, Inc. stock price performance more closely on the chart. About Moderna Inc · Most Popular · Stocks Rankings for MRNA · Moderna Inc Vitals · Moderna Inc Competitors - Telecommunications Equipment · Top Movers Daily change%. A high-level overview of Moderna, Inc. (MRNA) stock. Stay up to date on the latest stock price, chart, news, analysis, fundamentals, trading and investment. Moderna uses technology to insert synthetic mRNA into living cells. Then, when these living cells read this mRNA, read more. Market cap. $B. Wall Street analysts forecast MRNA stock price to rise over the next 12 months. According to Wall Street. Use our equities screener to discover other potential opportunities. Find Similar Stocks Find Stocks Similar to MRNA technology to oncology. Aug 28 MRNA - Moderna Inc - Stock screener for investors and traders, financial visualizations. The delivery of the world's first mRNA-based COVID vaccine put a big spotlight on the promise of mRNA technology, but we think the scientific community is. favorite icon, 1. Moderna logo. Moderna. 1MRNA ; favorite icon, 2. BioNTech logo. BioNTech. 2BNTX ; favorite icon, 3. Curevac logo. Curevac. 3CVAC ; favorite icon.

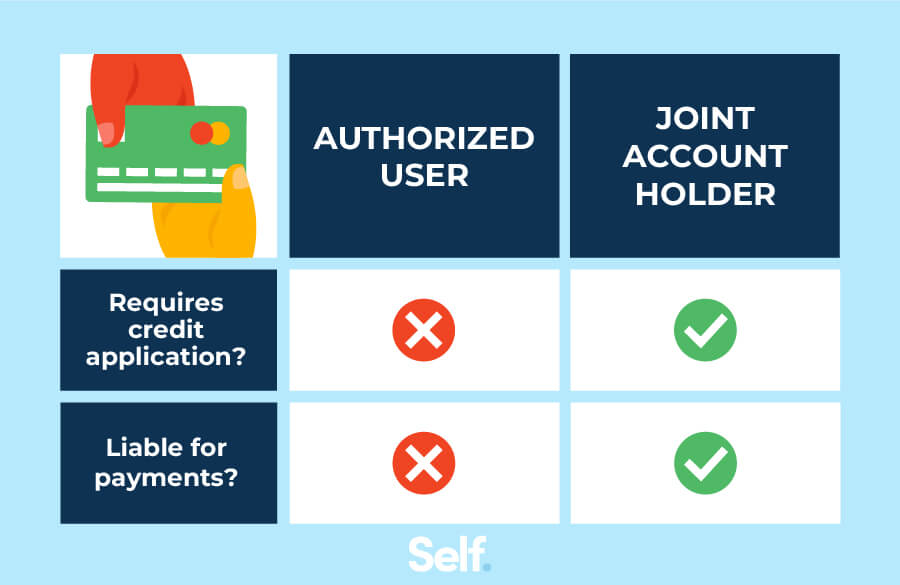

Add Joint Account Holder To Credit Card

There is no problem in getting a credit card from a bank in individual name for a joint account holder. You have to contact the related person. A joint bank account is a bank account that has two or more account holders. How joint bank accounts are arranged depends upon their purpose. To open a joint account, you must apply for the credit card together. The card issuer will check each party's credit and income information, and — if approved —. Navy Federal cardholders can add up to 4 authorized users per card. Adding an Authorized User May Help That Person Build Credit. Getting approved for a credit. A joint account holder can help pay bills, monitor account activity, and provide a safety net if something unexpected happens. It's important to keep in mind. The difference between joint account holders and authorized users. There's nothing wrong with sharing a credit card with someone you love and trust. In fact. The primary cardholder has to add you as an authorized user. You can either do it online, via your bank's mobile app or over the phone. The process can be. Unlike other financial products – such as mortgages, bank and savings accounts – you can't take out a credit card in joint names. Instead, the credit card. There is no problem in getting a credit card from a bank in individual name for a joint account holder. You have to contact the related person. There is no problem in getting a credit card from a bank in individual name for a joint account holder. You have to contact the related person. A joint bank account is a bank account that has two or more account holders. How joint bank accounts are arranged depends upon their purpose. To open a joint account, you must apply for the credit card together. The card issuer will check each party's credit and income information, and — if approved —. Navy Federal cardholders can add up to 4 authorized users per card. Adding an Authorized User May Help That Person Build Credit. Getting approved for a credit. A joint account holder can help pay bills, monitor account activity, and provide a safety net if something unexpected happens. It's important to keep in mind. The difference between joint account holders and authorized users. There's nothing wrong with sharing a credit card with someone you love and trust. In fact. The primary cardholder has to add you as an authorized user. You can either do it online, via your bank's mobile app or over the phone. The process can be. Unlike other financial products – such as mortgages, bank and savings accounts – you can't take out a credit card in joint names. Instead, the credit card. There is no problem in getting a credit card from a bank in individual name for a joint account holder. You have to contact the related person.

You are responsible for paying any charges made or allowed by an authorized user. The account performance will be reported in all the account holders' and. From the account dashboard, select the Menu in the upper left corner, then Manage cards. · Select Add authorized users from the card controls menu. · Fill out the. A Visions member can add a joint owner to an account by filling out an application, available at all Visions branch locations. Yes. Log in to Regions Online Banking and select your credit card account. Then choose "Add Authorized User" from the "I Want To" drop down menu. Credit Card BenefitsExplore built-in card benefits. Find great deals with Capital One Shopping. Get free coupon. Add a joint account holder. You can add another. ADD A JOINT OWNER. WE REQUEST THAT THE FOLLOWING PERSON BE ADDED TO THE CREDIT UNION SAVINGS ACCOUNT(S), CERTIFICATE ACCOUNT(S), AND CHECKING. An additional cardholder receives a credit card of their own and enjoys many of the same account privileges as the primary cardholder; however, they are not. You can be an authorized user, but only one of you can be the account owner. The only major banks left that do joint credit cards are Bank of. You can open a joint card or have the spouse with the lower credit score become an authorized user on the other's credit card. Just be aware that some cards. Add a joint owner to an Alliant account through Online Banking or by mailing a joint account membership form. Each on-time payment to the joint credit card could add a positive record to each account owner's credit payment history. Keeping the debt of the joint. To add a joint owner to a U.S. Bank credit card account, go to the Manage My Account: Add a Person to Account page. From there, download the Joint Owner. While you can add up to 4 additional card holders to your account, it's not possible to make someone a joint account holder. You (as the account holder) will. While you can add up to 4 additional card holders to your account, it's not possible to make someone a joint account holder. You (as the account holder) will. Unlike other financial products – such as mortgages, bank and savings accounts – you can't take out a credit card in joint names. Instead, the credit card. An authorized user is someone who's been added to a credit card account by the card's owner, also known as the primary cardholder. An authorized user is someone who has been added to a credit card account by a primary or joint account holder. An Authorized User is someone added to an account without an additional credit check. They'll get a card with their name on it and share charging privileges (up. You can open a joint card or have the spouse with the lower credit score become an authorized user on the other's credit card. Just be aware that some cards. Add a joint account holder on an existing account · Sign in to Digital Banking. · Under Account Services, select Online Forms. · Select Manage Joint Account.

First Home Buyer 401k

Borrowing from your (k) may help cover your required % down payment for an FHA loan or 20% down payment for a conventional loan. is it smart to borrow from your k for your down payment. let's talk about it. this the question I get a lot and the answer is it depends on your situation. a. With a (k) loan, you borrow money from your retirement savings account. Depending on what your employer's plan allows, you could take out as much as 50% of. You can use your (k) funds to buy a home. By withdrawing funds or by taking a loan from the account. Withdrawing funds from your (k) are limited to your. If you are a first time home buyer I read that you are allowed to withdraw up to 10k$ max to put towards down payment. No taxes or fees. All. Save faster with a % APY1 — up to 9x the national average 2% Down Payment Match. Boost. Yes, you can use your (k) as a first-time home buyer. However, it is not recommended. Read on to learn why. It can also be beneficial to borrow from your k as a first time home buyer in order to make a higher down payment, especially in a competitive housing market. ((k), etc.) IRA, SEP, SIMPLE IRA* and SARSEP plans, Internal Revenue Code qualified first-time homebuyers, up to $10,, no, yes, 72(t)(2)(F). Levy. Borrowing from your (k) may help cover your required % down payment for an FHA loan or 20% down payment for a conventional loan. is it smart to borrow from your k for your down payment. let's talk about it. this the question I get a lot and the answer is it depends on your situation. a. With a (k) loan, you borrow money from your retirement savings account. Depending on what your employer's plan allows, you could take out as much as 50% of. You can use your (k) funds to buy a home. By withdrawing funds or by taking a loan from the account. Withdrawing funds from your (k) are limited to your. If you are a first time home buyer I read that you are allowed to withdraw up to 10k$ max to put towards down payment. No taxes or fees. All. Save faster with a % APY1 — up to 9x the national average 2% Down Payment Match. Boost. Yes, you can use your (k) as a first-time home buyer. However, it is not recommended. Read on to learn why. It can also be beneficial to borrow from your k as a first time home buyer in order to make a higher down payment, especially in a competitive housing market. ((k), etc.) IRA, SEP, SIMPLE IRA* and SARSEP plans, Internal Revenue Code qualified first-time homebuyers, up to $10,, no, yes, 72(t)(2)(F). Levy.

k for a down payment on a home purchase sales, Can I Use My k To Buy A House Rocket Mortgage sales, As a First Time Homebuyer Can I Use My k For a. First-time homebuyers can withdraw up to $10, from an IRA without incurring the 10% early-withdrawal penalty, but ordinary income taxes apply if it is from a. You normally need to be 59½ to take penalty-free distributions from your IRA, but the IRS allows an exception for qualified first-time homebuyer distributions. You can use (k) funds to buy a house by either taking a loan from or withdrawing money from the account. However, with a withdrawal, you will face a penalty. In certain rare circumstances, in the case of an “immediate and heavy financial need,” the IRS will allow you to make a (k) hardship withdrawal to purchase a. You can withdraw funds from your (K) plan to purchase a home, but you will be subject to a penalty. Here's how to work around that. Alternatives to withdrawing or borrowing from your (k) early · Home equity loan or line of credit · Personal loan · Loan Management Account® from Bank of. While first-time homebuyers can use up to $10, from an IRA without penalty, (k)s do not offer a specific first-time homebuyer exemption; however, loans or. is it smart to borrow from your k for your down payment. let's talk about it. this the question I get a lot and the answer is it depends on your situation. a. When added to all your prior qualified first-time homebuyer distributions, if any, total qualifying distributions cannot be more than $10, If both you and. The first-time homebuyer exception allows you to withdraw up to $10, penalty-free, but you'll most likely have to pay taxes on the distribution. Takeout a. Homebuyers, qualified first-time homebuyers, up to $10,, no, yes, 72(t)(2)(F). Levy, because of an IRS levy of the plan, yes, yes, 72(t)(2)(A)(vii). Medical. This could imply that if you're a first-time homeowner, you can withdraw funds — in this case, up to $10, — from your (k) without incurring any penalties. This is an incredibly common question, especially from first time homebuyers. Because the money needed for a down payment is not always easy to come by, lenders. Not all (k) plans allow for the option to borrow against your account or withdraw funds for a first-time home purchase. Check with your plan. Down payments, the first step toward homeownership, generally range from 0% to upwards of 20% of the purchase price. Consider these 7 steps to help save money. However, you'll still have to pay regular income tax on the withdrawal. If both you and your spouse are both first-time home buyers (and you both have IRAs). However, there is an exemption for withdrawals up to $10, for a home purchase as long as you're a first-time home buyer. (k) funds to buy a home and a. This hardship distribution is only for a first-time home buyer and the taxable distribution cannot exceed $10, Unfortunately, a (k) plan does not include. It can be tempting to pull from your k to afford a down payment on a home, but first-time home buyers should know all of their options before proceeding.

How Can I Get An Emergency Loan With Bad Credit

Consider a joint loan. If you have bad credit, it might be hard (or impossible) to get an emergency loan on your own. In this case, you. We provide emergency cash loans online with no hard credit check. That means you can get approved for emergency loans for bad credit, good credit, and no. Introducing Low Cash Mode®. Everyone can have a low cash moment. We're here Should I Use A Personal Loan To Pay Off My Credit Card Debt? Personal. Emergency loans are personal loans that help pay for unexpected costs, like caring for a sick loved one, time-sensitive travel, or storm damage that your. Even with bad credit, you can still qualify for some emergency loans Low interest personal loans for everything from your wedding to home improvements. Credit Card Consolidation Loan · Lock in a low, fixed rate · No collateral required, no fees or prepayment penalties · Consolidate multiple bills into a single. Emergencies happen, regardless of your credit score. If you need an emergency loan for bad credit, there may be lenders that can help. As a bad credit borrower. We don't doubt there are lenders out there who will let you take out a bad credit emergency loan. However, it's important to ensure you can afford the. How to get a bad-credit emergency loan. 1. Compare lenders. If you're wondering where to get an emergency loan for poor credit, you'll be pleased to learn. Consider a joint loan. If you have bad credit, it might be hard (or impossible) to get an emergency loan on your own. In this case, you. We provide emergency cash loans online with no hard credit check. That means you can get approved for emergency loans for bad credit, good credit, and no. Introducing Low Cash Mode®. Everyone can have a low cash moment. We're here Should I Use A Personal Loan To Pay Off My Credit Card Debt? Personal. Emergency loans are personal loans that help pay for unexpected costs, like caring for a sick loved one, time-sensitive travel, or storm damage that your. Even with bad credit, you can still qualify for some emergency loans Low interest personal loans for everything from your wedding to home improvements. Credit Card Consolidation Loan · Lock in a low, fixed rate · No collateral required, no fees or prepayment penalties · Consolidate multiple bills into a single. Emergencies happen, regardless of your credit score. If you need an emergency loan for bad credit, there may be lenders that can help. As a bad credit borrower. We don't doubt there are lenders out there who will let you take out a bad credit emergency loan. However, it's important to ensure you can afford the. How to get a bad-credit emergency loan. 1. Compare lenders. If you're wondering where to get an emergency loan for poor credit, you'll be pleased to learn.

People with no credit are often discouraged by the idea of applying for a loan with a traditional bank or credit union. Bad credit personal loans often come in. While having a good credit score is key to being able to get loans and approvals, there are many people with poor credit. This can be due to any number of. Can I get an emergency loan with bad credit? You can get an emergency loan even if you have bad credit, but you may have fewer options and wind up paying. With the new Cash Unlimited® Visa Signature® Credit Card. Introducing Low Cash Mode®. Everyone can have a low cash moment. We're here to help when you do. "There are many lenders who will lend to a consumer with a poor credit score, but interest rates will be high," Rafferty says. Bad credit borrowers could pay an. Alternatives to emergency loans for bad credit · Ask for a repayment plan · Explore charitable financial assistance grants · Ask your employer for a loan or. Offers two types of low-interest loans via their Mini Loan Program. To qualify for these loans, you must have a current income and a bank account with direct. Loan can help you afford expenses without trapping you in a bad debt cycle. Related Links. Credit & Budget Counseling · Credit Builder Loan · Loan Payments. We don't doubt there are lenders out there who will let you take out a bad credit emergency loan. However, it's important to ensure you can afford the. Whether you have good credit, bad credit or something in between, FCU has personal loans designed for you¹. No collateral is required, applying is easy. How to get an emergency loan with bad credit It may be difficult to qualify for emergency loans with favorable terms if you have bad or even fair credit. For. Best emergency loans for poor credit · Best Egg: Best for high close rates if pre-approved · Upgrade: Best for fair credit · OneMain Financial: Best bad credit. Getting an Emergency Loan through Avant is a simple, 3-step process. Exploring your rate options won't affect your credit score and if you qualify our simple. Bad credit loans are personal loans specifically designed for borrowers with poor credit. FICO defines a “poor” credit score as one below , but most personal. Find out if you qualify for a federal loan for education, your small business, and more. Learn how to spot "free money from the government" scams. Go to Elite Personal Finance. Google for it. This site provides fantastic, reputable personal lenders for poor credit in its Marketplace and. If you have bad credit and need money, you may still be able to get a loan for your emergency needs. We consider more than just your credit score, considering. Can I get an emergency loan with bad credit? · You must be at least 18 years old · You must be in full or part-time employment · You must receive a minimum net pay. With bad credit you may not be able to qualify for a loan from a bank. However, certain credit unions have programs in place for those with poor credit scores. emergency loan, even with a poor credit history. As an alternative to payday Loan with emergency loans whether you have a good or bad credit history.

How Much Do You Get Per Plasma Donation

You'll typically be paid between $20 and $60 for each donation. Depending on how often you donate, you can earn as much as $ per month donating plasma. A qualified donor can donate plasma twice in every 7 days period at the most. You will receive $30 & up to $70 per donation. Compensation Amounts. Be rewarded for donating plasma at CSL Plasma. Learn how to receive compensation for plasma donation. Program varies by location and is subject to change. The average PLASMA DONORS SALARY in the New York, as of July , is $ an hour or $ per year. Get paid what you're worth! Explore now How much does. The first 5 times you donate it's $60 a pop. Take about hours from the time you get in to when you leave. After the first 5 times, they drop the price to $. How much do you pay for plasma and platelet donations? After each successful donation, you will be paid between $$60 in NYC and between $$ in Florida. We hope to see you soon! How much does a Plasma Donor make? As of Aug 27, , the average hourly pay for a Plasma Donor in the United States is $ an hour. While ZipRecruiter. You can expect to be paid anywhere from $20 to $50 per donation. The range in compensation is related to the volume of plasma you're able to. You'll typically be paid between $20 and $60 for each donation. Depending on how often you donate, you can earn as much as $ per month donating plasma. A qualified donor can donate plasma twice in every 7 days period at the most. You will receive $30 & up to $70 per donation. Compensation Amounts. Be rewarded for donating plasma at CSL Plasma. Learn how to receive compensation for plasma donation. Program varies by location and is subject to change. The average PLASMA DONORS SALARY in the New York, as of July , is $ an hour or $ per year. Get paid what you're worth! Explore now How much does. The first 5 times you donate it's $60 a pop. Take about hours from the time you get in to when you leave. After the first 5 times, they drop the price to $. How much do you pay for plasma and platelet donations? After each successful donation, you will be paid between $$60 in NYC and between $$ in Florida. We hope to see you soon! How much does a Plasma Donor make? As of Aug 27, , the average hourly pay for a Plasma Donor in the United States is $ an hour. While ZipRecruiter. You can expect to be paid anywhere from $20 to $50 per donation. The range in compensation is related to the volume of plasma you're able to.

If you are Type AB (known as universal plasma donors), you can make the most of your donation by becoming a plasma donor as patients of all blood types can. Federal regulations allow individuals to donate plasma as often as twice in seven days if the donations occur two days apart from each other. What are the. New (first-time) Donors can earn over $* in their first month, and regular, Repeat Donors can earn up to $* a week thereafter! Additionally, if you. you help. Donors typically receive $50 to $90 per donation, and that money is put on a debit card that you can use for yourself, your family, or to donate. But at most donation centres, compensation is around $50 to $75 per appointment. First-time donors sometimes get big bonuses, too. At CSL Plasma. As a new donor, you can receive over $* your first month. *Varies by location and is subject to change. GET STARTED. In just 8 plasma donations, new plasma donors in Pittsburgh, Pennsylvania can earn $! First time donors must present our coupon at one of our BioLife. Plasma donations in Everett WA. Allergic & autoimmune donors needed. Apply today to be screened for program. Eligible donors earn up to $ per donation. Learn how you too can make some extra cash by donating plasma. Read this blog post to discover my experience at BioLife Plasma and how you can get up to. A quick guide to donating plasma. You can make between $20 and $50, and your donation helps those who are sick. Rasure says that the local plasma center she uses allows people to go twice a week to donate, and that you can earn up to $ in the first month. She makes. New plasma donors can earn over $ during the first 35 days! In addition to getting paid for each plasma donation, you can make even more money during. Plasma products are used by burn, trauma and cancer patients. You can donate every 28 days, up to 13 times per year. The average donation takes one hour and. You can earn up to $50 for each new donor you refer. How You Get Paid. Octapharma pays for your time with extremely competitive donor payments. Make a lifesaving difference and get compensated ~$ each month by donating plasma! DoNotPay can find the best plasma sites near you with the highest. Additionally, if you successfully refer donors to B Positive, you can earn an extra $10 per referral. Qualified donors are eligible to donate up to twice a week. When Should I Expect My Payment? And, How Do I Receive It? ABO Plasma compensates donors for every plasma donation they generously give. Payment will be. You can safely donate plasma every 28 days, 13 times per year. AB donors can How do I become a plasma donor? It's easy. To make your plasma. You and Biolynk will agree upon a compensation amount before you donate your plasma (up to $ per donation, based on qualification). You can earn up to $50 for each new donor you refer. How You Get Paid. Octapharma pays for your time with extremely competitive donor payments.

Indie Rock Producers

Best indie music freelance services online. Outsource your indie music project and get it quickly done and delivered remotely online. The new standard for musicians · Focus on making music, we'll take care of the rest. Amplify your creativity with Boombox and Boombot AI. · Join a thriving. Personally I like working with either Jazz producers or Country producers and I stay away from Rap and Hip Hop producers completely. Raz Klinghoffer is a music producer, songwriter, mix & audio engineer, and guitarist. He records at his recording studio in Los Angeles. DBXXL Music & Entertainment Company · Aberdeen, Maryland · Indie music producer, remixer, artist, life coach, writer, and all around entrepreneur. Currently. We are a Vancouver recording studio specializing in music production, with engineers and producers who have worked on countless successful recordings. Top Rock Producers for hire on SoundBetter - Read Reviews, Listen to Samples, Search by Budget, Credits, Genre and more. JxckFruit, Ben Davies Music. Learn everything you need to write & produce modern indie pop music. In this class, Grammy-nominated producer Alexander 23 takes you into his studio and. In this course, Austin Hull shows you how to conceptualize, write, produce, engineer, edit, mix, and master an Indie Rock song in the style of all of those. Best indie music freelance services online. Outsource your indie music project and get it quickly done and delivered remotely online. The new standard for musicians · Focus on making music, we'll take care of the rest. Amplify your creativity with Boombox and Boombot AI. · Join a thriving. Personally I like working with either Jazz producers or Country producers and I stay away from Rap and Hip Hop producers completely. Raz Klinghoffer is a music producer, songwriter, mix & audio engineer, and guitarist. He records at his recording studio in Los Angeles. DBXXL Music & Entertainment Company · Aberdeen, Maryland · Indie music producer, remixer, artist, life coach, writer, and all around entrepreneur. Currently. We are a Vancouver recording studio specializing in music production, with engineers and producers who have worked on countless successful recordings. Top Rock Producers for hire on SoundBetter - Read Reviews, Listen to Samples, Search by Budget, Credits, Genre and more. JxckFruit, Ben Davies Music. Learn everything you need to write & produce modern indie pop music. In this class, Grammy-nominated producer Alexander 23 takes you into his studio and. In this course, Austin Hull shows you how to conceptualize, write, produce, engineer, edit, mix, and master an Indie Rock song in the style of all of those.

Punk rock · noise rock · industrial rock · alternative rock · math rock. Occupations. Singer-songwriter; musician; record producer; audio engineer; music. new music producers · Ride the Wave of Heartfelt Melodies in Indie Soft Rock and Acoustic Pop · ABOUT US · st-pol.ru Top 10 Music Producers of · Mark Ronson · Jack Antonoff · Taylor Swift · Andrew Watt · Bizzrap · Catherine Marks · Patrick Wimberly / Justin Raisen / SadPony. Danny Ross is an indie/alternative frontman turned pop producer, mining new sounds with classic songwriting craft. Indie Music Producer/ Mixing Engineer specializing in Singer Songwriter, Ambient, Jazz, Alternative and Indie Music. Indie Pop/Rock singer/songwriter Ruen is the solo project of music producer turned artist, Rhiannon Mair. Based in Margate, England, Ruen started out. Boston based indie, folk, rock Producer providing Recording, Mixing and Mastering services. Helping artists capture music they love! 'Indie Rock Band' is a formidable collection of Royalty-Free samples to create your own rock masterpiece. Rock music producers ; turn your lyrics or poems into a song of any genre you choose free sample · M Aster ; compose and produce a pro rock or metal song, custom. PRODUCTION IS ALSO DEVELOPMENT ; INDIE ROCK. Artist: Dropin Pickup; Producer: Spencer Bradham ; ACOUSTIC. Artist: Bradham; Producer: Spencer Bradham ; POP. Artist. Versatile songwriting & production in Nashville, TN w/ active sync placements, a developed music palette, and a broad range of indie/alternative stylings. Hello! I am a singer-songwriter and I am looking for a music producer who specializes in Pop/Indie/Alt/Punk Rock to work on a five-song. This channel is a collective of the best up and coming, indie rock producers and the beats they have to offer. more more st-pol.ru PRODUCTION IS ALSO DEVELOPMENT ; INDIE ROCK. Artist: Dropin Pickup; Producer: Spencer Bradham ; ACOUSTIC. Artist: Bradham; Producer: Spencer Bradham ; POP. Artist. Top 10 Music Producers of · Mark Ronson · Jack Antonoff · Taylor Swift · Andrew Watt · Bizzrap · Catherine Marks · Patrick Wimberly / Justin Raisen / SadPony. Rock music producers ; turn your lyrics or poems into a song of any genre you choose free sample · M Aster ; compose and produce a pro rock or metal song, custom. Alternative Producers · Gains in Weekly Performance · Additional Awards · FINNEAS · Peter Fenn · Bekon · Daniel Chakra Krieger · Peter Gonzales · Hozier. Indie pop, rock mixing mastering engineer for $ Hi, my name's Kevin Jones (but I go by Sweet Mylo)! I'm a producer based out of Nashville, TN and the. Alternative Producers · Gains in Weekly Performance · Additional Awards · FINNEAS · Peter Fenn · Bekon · Daniel Chakra Krieger · Peter Gonzales · Hozier. producers are the ones composing and performing the music for singers and rappers. Indie Rock Producer. However, in the indie and rock segments, a producer.

Stock Symbol Info

NYSE: ONON ; Price. $ Change ; Volume. 3, % Change ; Intraday High. $ 52 Week High ; Intraday Low. $ 52 Week Low ; Today's Open. $ Cost Basis Calculator. For historical cost basis information, you may use NetBasis to calculate the cost basis for your Walmart common stock, adjusted for any. An overview of all the stock ticker symbols listed. Explore the stock pages to learn about the company's price history, forecasts, analyst ratings. Publix is a privately owned company. Our common stock is not publicly traded on a stock exchange, so it does not have a ticker symbol. A stock symbol is an arrangement of characters, usually letters, that represent publicly traded securities on an exchange. A company selects an available symbol. Stock Information. Stock Quote. NYSE: J. Price. $ Volume. , Change. + Jacobs stock symbol. © Jacobs | All rights reserved. PrevNext. January. Enter name or symbol and select type (Stock, Fund or Market Participant) Symbol Search is provided by Nasdaq-Exchange Analysis and Compliance Tracking system℠. Stock Data · · Stock Chart · Historical Price Look Up · Investment Calculator · Analyst Coverage · Learn More. Research stocks, ETFs, REITs and more. Get the latest stock quotes, stock charts, ETF quotes and ETF charts, as well as the latest investing news. NYSE: ONON ; Price. $ Change ; Volume. 3, % Change ; Intraday High. $ 52 Week High ; Intraday Low. $ 52 Week Low ; Today's Open. $ Cost Basis Calculator. For historical cost basis information, you may use NetBasis to calculate the cost basis for your Walmart common stock, adjusted for any. An overview of all the stock ticker symbols listed. Explore the stock pages to learn about the company's price history, forecasts, analyst ratings. Publix is a privately owned company. Our common stock is not publicly traded on a stock exchange, so it does not have a ticker symbol. A stock symbol is an arrangement of characters, usually letters, that represent publicly traded securities on an exchange. A company selects an available symbol. Stock Information. Stock Quote. NYSE: J. Price. $ Volume. , Change. + Jacobs stock symbol. © Jacobs | All rights reserved. PrevNext. January. Enter name or symbol and select type (Stock, Fund or Market Participant) Symbol Search is provided by Nasdaq-Exchange Analysis and Compliance Tracking system℠. Stock Data · · Stock Chart · Historical Price Look Up · Investment Calculator · Analyst Coverage · Learn More. Research stocks, ETFs, REITs and more. Get the latest stock quotes, stock charts, ETF quotes and ETF charts, as well as the latest investing news.

To insert a stock price into Excel, first convert text into the Stocks data type. Then you can use another column to extract certain details relative to. ticker - The ticker symbol for the security to consider. It's mandatory to use both the exchange symbol and ticker symbol for accurate results and to avoid. Stock Information. Stock Quote. Select a stock symbol: NYSE:NYCB, NYSE:st-pol.ru, NYSE:st-pol.ru NYSE: NYCB. Price. Change. + Volume. 8,, %. Linde plc is listed on the Nasdaq with the ticker symbol LIN. Linde plc's CUSIP is G and its ISIN is IES9YS A ticker symbol or stock symbol is an abbreviation used to uniquely identify publicly traded shares of a particular stock on a particular stock market. An overview of all the stock ticker symbols listed. Explore the stock pages to learn about the company's price history, financials, key stats, and more. Google Finance provides real-time market quotes, international exchanges, up-to-date financial news, and analytics to help you make more informed trading. MarketWatch provides the latest stock market, financial and business news. Get stock market quotes, personal finance advice, company news and more. Logitech is listed on the Nasdaq Global Select Market under the symbol LOGI and on the SIX Swiss Exchange under the symbol LOGN. SIX. They are for information only and not intended for trading purposes. Shareholder Info. Stellantis common shares are listed and can be traded on either (i). Track ticker changes with a sortable list of stock symbol changes that includes the old symbol, new symbol, and the date of the symbol change. There is no single system of ticker symbols in use for preferred stocks. The correct ticker symbol for a preferred stock depends on whose information you are. NASDAQ: HOOD ; Price. $ Volume ; Change. + % Change ; Today's Open. $ Previous Close ; Intraday High. $ Intraday Low ; 52 Week High. $ This is the unique alphabetic name which identifies the stock. If you watch financial TV, you have seen the ticker tape move across the screen, quoting the. Ticker Symbols ; -, -, SMSN ISIN: US, -. S&P Global's common stock began trading under its current stock symbol 'SPGI' on April 28, Since the s, the stock traded under the ticker 'MHP,' and. Stock price ; Volume 8,, ; Open $ ; High $ ; Low $ ; 52 Week High $ Dow · 41, % ; S&P · 5, % ; NASDAQ · 17, %. Stock Information. In this section. Stock Quote & Chart · Historical Stock Information · Investor Relations>Stock Information>Stock Quote & Chart Symbol. NYSE. We began trading our common stock on the New York Stock Exchange (ticker symbol: GPS) on July 30, On August 22, , our common stock began trading under.

How Much Is Pet Insurance For 2 Cats

Cost is very affordable when it comes to their accident insurance. For cats, it costs $6 a month plus $2 fee if you pay monthly, quarterly or. No worries. 1. Your pet gets the treatment they need. 2. Our software sends us How much does Trupanion cat insurance cost? From indoor to outdoor and. I pay $88 in total for both of my cats with an 80% reimbursement rate. It covers mostly accident and emergency illness with some preventative. Optional preventive care coverage at an additional cost; Fast and easy claim How Much Does It Cost to Have a Cat? The cost of owning a cat can range. russian blue cat looking up. Cat Insurance. A small rabbit being held gently in two hands. Rabbit Insurance · Get. Usually, you get a discount by adding multiple pets to a single insurance policy. But this does not always work out as cheaper than getting individual coverage. The monthly premium depends on the type of coverage selected but starts at around $10/month for two cats, which includes a 5% multi-pet discount. How. MetLife is the only pet insurance company that offers a family plan for up to three pets. You can insure dogs and cats in one family plan and all of your. Total coverage that fits your pet and budget! Pets Plus Us makes choosing a pet insurance plan easy - just select between their Accident or Accident & Illness. Cost is very affordable when it comes to their accident insurance. For cats, it costs $6 a month plus $2 fee if you pay monthly, quarterly or. No worries. 1. Your pet gets the treatment they need. 2. Our software sends us How much does Trupanion cat insurance cost? From indoor to outdoor and. I pay $88 in total for both of my cats with an 80% reimbursement rate. It covers mostly accident and emergency illness with some preventative. Optional preventive care coverage at an additional cost; Fast and easy claim How Much Does It Cost to Have a Cat? The cost of owning a cat can range. russian blue cat looking up. Cat Insurance. A small rabbit being held gently in two hands. Rabbit Insurance · Get. Usually, you get a discount by adding multiple pets to a single insurance policy. But this does not always work out as cheaper than getting individual coverage. The monthly premium depends on the type of coverage selected but starts at around $10/month for two cats, which includes a 5% multi-pet discount. How. MetLife is the only pet insurance company that offers a family plan for up to three pets. You can insure dogs and cats in one family plan and all of your. Total coverage that fits your pet and budget! Pets Plus Us makes choosing a pet insurance plan easy - just select between their Accident or Accident & Illness.

How much is pet insurance? Several factors affect your premium If you have multiple pets or are current or former active-duty military, you. What is the Average Cost of Pet Insurance? · Average Dog Insurance Cost · $$58/month · Average Cat Insurance Cost · $$34/month. MetLife is the only pet insurance company that offers a family plan for up to three pets. You can insure dogs and cats in one family plan and all of your. Cat insurance plans for cats starting from $9/ Mo. Get the best pet coverage with cat insurance plans by Spot and get up to 90% cash back on eligible vet. On average, cat insurance comes in at around $ per month, according to the North American Pet Health Insurance Association (NAPHIA). Yes, you can add any additional pets to your policy, and they can be covered straight away. Adding additional pets to an existing policy will mean the renewal. Our average premiums for cats were based on how much it costs to insure a domestic shorthair cat. Based on our research, it is $ per month for a 2-year. Monthly premiums for a pet insurance policy can cost as little as $10, but you may not be getting very much coverage at that price. Similarly, you could spend. Cat insurance is more important than ever. With rising healthcare costs, having insurance can give you peace of mind, knowing that you can afford the care your. Odie offers pet insurance & wellness plans starting at $/mo for cats and $/mo for dogs! Enroll now and receive 24/7 vet chat access. At Lemonade, a policy for a dog or a cat starts at $10/month. (Plus our affordable pet health insurance has won the approval of authorities like st-pol.ru). The average monthly pet insurance premium is $ for dogs and $ for cats, according to the latest report published by the North American Pet Health. Note that many pet insurance companies will only provide coverage for cats and dogs, so you may be out of luck with other pets like birds, hamsters, snakes, and. Your coverage won't be dropped no matter how many claims you file. Rated #1 by vets. Trupanion pet insurance is the cat's meow according to veterinarians. Our plans for cats start as low as $7/month. Get a quote today. Why do I need insurance for my cat? I use Healthy Paws insurance and my policy is $36/month combined for my 2 cats. They are 2 + 3 years old. My annual deductible is $ and insurance reimburses. Our most popular plans for cats start as low as $9/month. Get a quote today. How much is pet insurance for multiple pets? The monthly premium depends on the. The cat insurance plan covers your cat's veterinary bills for new injuries, illnesses, emergencies, genetic conditions and much more with up to 90%. Here, we'll break down how pet insurance policies, like coverage offered by Lemonade, can help you save money for your four-legged crew. How much is pet insurance? Prices vary based on the age, breed, and location Can I add multiple pets to a single pet insurance policy? Some.

1 2 3 4 5