st-pol.ru

Gainers & Losers

Safest Investment For Large Sum Of Money

:max_bytes(150000):strip_icc()/money-grow-up-959526226-a59ffa09aeee40e592e497bc794434ec.jpg)

Which would be a better short term safe investment for large sum of money. Official Response. Hello everyone, I am fairly new to investing and. An income annuity is a contract between you and an insurance company where you pay a sum of money best fits your needs. Annuities may provide safety. You seek to purchase more shares when prices are low and fewer shares when prices rise, to avoid the risk of investing a lump-sum amount when prices are at. Primarily electronic – keep them safe in your TreasuryDirect account (minimum amount $25). You can choose to use all or part of your IRS tax refund to buy. Lumpsum investment is a method of investment in mutual funds wherein you invest a big chunk of money in one go. If you have a large corpus of cash. An upfront payment might enable you to buy a house or other large purchase that you would otherwise not be able to afford. Similarly, you can invest the money. Gold, · Insure yourself (In your 20's by life insurance), · Stock Market(Fundamentally Sound Stock), · Mutual funds - Go for index funds if. These are an investment contract you have with a bank to pay you a guaranteed rate of return when you deposit money for a specified amount of time. CDs are. Cash and cash equivalents such as certificates of deposit (CDs) or money market funds are among the safest and most liquid of investments. Cash is available. Which would be a better short term safe investment for large sum of money. Official Response. Hello everyone, I am fairly new to investing and. An income annuity is a contract between you and an insurance company where you pay a sum of money best fits your needs. Annuities may provide safety. You seek to purchase more shares when prices are low and fewer shares when prices rise, to avoid the risk of investing a lump-sum amount when prices are at. Primarily electronic – keep them safe in your TreasuryDirect account (minimum amount $25). You can choose to use all or part of your IRS tax refund to buy. Lumpsum investment is a method of investment in mutual funds wherein you invest a big chunk of money in one go. If you have a large corpus of cash. An upfront payment might enable you to buy a house or other large purchase that you would otherwise not be able to afford. Similarly, you can invest the money. Gold, · Insure yourself (In your 20's by life insurance), · Stock Market(Fundamentally Sound Stock), · Mutual funds - Go for index funds if. These are an investment contract you have with a bank to pay you a guaranteed rate of return when you deposit money for a specified amount of time. CDs are. Cash and cash equivalents such as certificates of deposit (CDs) or money market funds are among the safest and most liquid of investments. Cash is available.

You could also consider borrowing against the value of your investments with a margin loan from a brokerage firm or with a securities-based line of credit. You could lose your principal, which is the amount you've invested. That's true even if you purchase your investments through a bank. The reward for taking on. What is a high-risk, high-return investment? · Cryptoassets (also known as cryptos) · Mini-bonds (sometimes called high interest return bonds) · Land banking. 1. Determine YOUR best savings strategy · Fixed savings accounts offer the top rates, though you can't access your cash. · Easy-access and notice accounts allow. 1. Certificates of deposit (CDs). CDs provide reliable, fixed-rate returns on a lump sum of money over a fixed period of time, such. You may owe a substantial amount of money even after your securities are sold. The margin account agreement generally provides that the securities in your. We believe a better strategy for optimizing your net worth is to invest for cash flow, turn a lump sum into an income stream, then fund a long-term whole life. The three safest investments are savings accounts, CDs and Treasury bonds. Daria Uhlig, Cynthia Measom and John Csiszar contributed to the reporting for this. For those looking to take less risk in their portfolios, traditionally safer investments include treasury bonds, money market funds, and “blue chip” stocks that. If you're actively searching for a home and need access to cash quickly, a money market fund may be your best bet. Money markets generally pay higher interest. Money market funds. · Dividend stocks. · Ultra-short fixed-income ETFs. · Certificates of deposit. · Annuities. · High-yield savings accounts. · Treasury bonds. For most investors, we'd recommend a broad mutual fund or ETF that tracks an index of stocks such as the S&P Index funds offer some of the easiest and most. There are many different buckets you can fill with money, such as a Roth IRA, HSA, or taxable brokerage account. Each of these accounts serve a different. Larger amounts of money increase the value of certain parts of financial planning, such as tax planning and tax-efficient investing, minimizing investment costs. Pay off your debts · Open a high-interest savings account · Spread your spending over time · Invest your money. Mutual funds are similar to ETFs. They pool investors' money and use it to accumulate a portfolio of stocks or other investments. The biggest difference is that. How can you save such a large sum? First, calculate your monthly cost-of Paula Pant is a personal finance journalist who has been featured on MSN Money. When deciding whether to invest a lump sum of money or smaller, regular But which is best, and what should investors think about when deciding between the two. Here are some of the best ways to use it SUBJECT TO INVESTMENT RISKS, INCLUDING POSSIBLE LOSS OF THE PRINCIPAL AMOUNT INVESTED. high liquidity and safety that it is easily converted into cash. Center for invest certain amounts of money at certain specified times. In exchange.

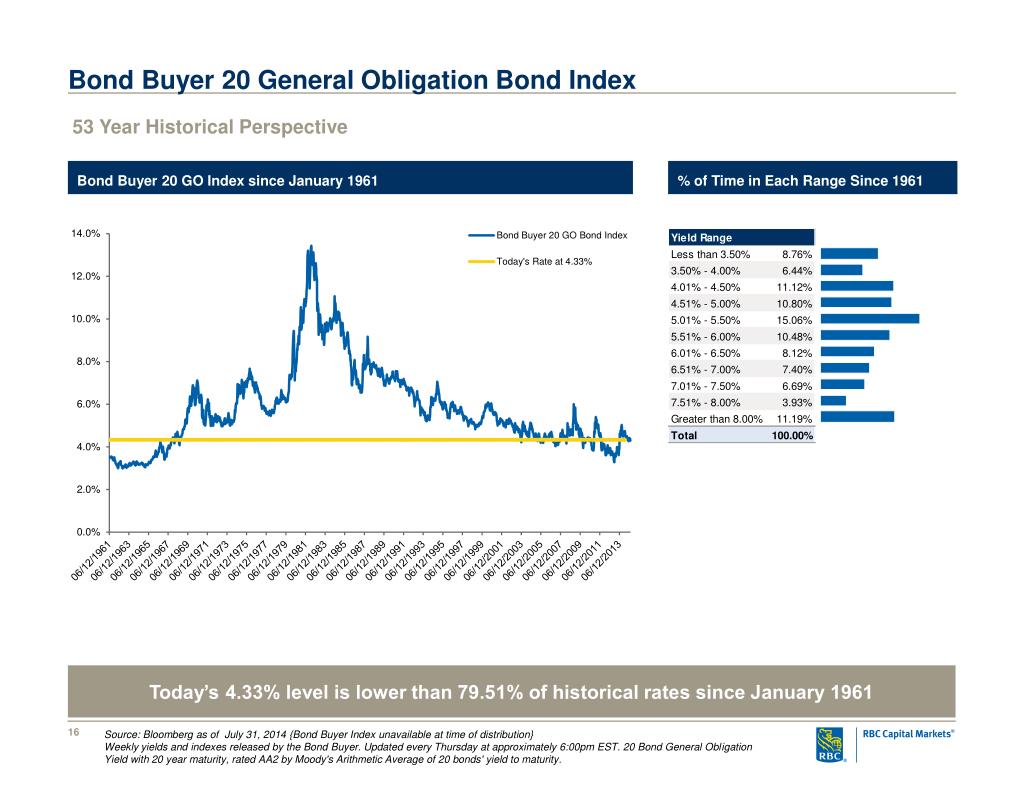

Bond Buyer 20 Bond Index

(3) Bonds may bear interest at a rate not to exceed an average net interest cost rate, which shall be computed by adding basis points to The Bond Buyer “ 20 specific GO bonds from the Bond Index. The Revenue Bond Index (Revdex) The Bond Buyer Municipal Bond Index provides an estimate of the prices. The bond index has an average rating equivalent to Moody's Aa2 and S&P's AA, while the bond index is equivalent to Aa1 and AA-plus. (No average Fitch. The finance charge will be assessed on financial assistance as follows: (1) for a contract term over 20 Bond Buyer's Municipal Bond Index's Current Day —. The Bond Buyer “20 Bond Index” (BBI) shows average yields on a group of municipal bonds that mature in 20 years and have an average rating equivalent to. bonds rated A or better, published daily. Bond Buyer 20 (20 bond index) - tracks 20 G.O. bonds rated A or better, published weekly. Bond Buyer 11 (11 bond. The Bond Buyer “20 Bond Index” (BBI) shows average yields on a group of municipal bonds that mature in 20 years and have an average rating equivalent to. Starting in July 1, , noncallable bonds became eligible for inclusion in the index. The publication also tracks the Bond Buyer 20 Bond Index, which is an. The Bond Buyer Index, also known as the BB40 index, is based on the prices of 40 recently issued and actively traded long-term municipal bonds. (3) Bonds may bear interest at a rate not to exceed an average net interest cost rate, which shall be computed by adding basis points to The Bond Buyer “ 20 specific GO bonds from the Bond Index. The Revenue Bond Index (Revdex) The Bond Buyer Municipal Bond Index provides an estimate of the prices. The bond index has an average rating equivalent to Moody's Aa2 and S&P's AA, while the bond index is equivalent to Aa1 and AA-plus. (No average Fitch. The finance charge will be assessed on financial assistance as follows: (1) for a contract term over 20 Bond Buyer's Municipal Bond Index's Current Day —. The Bond Buyer “20 Bond Index” (BBI) shows average yields on a group of municipal bonds that mature in 20 years and have an average rating equivalent to. bonds rated A or better, published daily. Bond Buyer 20 (20 bond index) - tracks 20 G.O. bonds rated A or better, published weekly. Bond Buyer 11 (11 bond. The Bond Buyer “20 Bond Index” (BBI) shows average yields on a group of municipal bonds that mature in 20 years and have an average rating equivalent to. Starting in July 1, , noncallable bonds became eligible for inclusion in the index. The publication also tracks the Bond Buyer 20 Bond Index, which is an. The Bond Buyer Index, also known as the BB40 index, is based on the prices of 40 recently issued and actively traded long-term municipal bonds.

A compilation of different indexes that are widely watched in the municipal bond industry. The following indexes provide an indication of the average weekly. For instance, if a jurisdiction's index value was in week one and in week two, its week-on-week change is %. All indices are updated each Monday just. bond buyers 20 bond index." bond buyer's weekly bond GO (general obligation) index. The average is determined using rates published on Monday of each. The bond index has an average rating equivalent to Moody's Aa2 and S&P's AA, while the bond index is equivalent to Aa1 and AA-plus. (No average Fitch. The Bond GO Index is based on an average of certain general obligation municipal bonds maturing in 20 years and having an average rating equivalent of a. The weekly average yield to maturity of The Bond Buyer Municipal Bond Index, which is based on 40 long-term bond prices, rose to % from % the week. Active investment strategies, by contrast, try to outperform bond indexes, often by buying and selling bonds to take advantage of price movements. E20 1JN) in. The S&P Municipal Bond 20 Year High Grade Rate Index consists of bonds in the S&P Municipal Bond Index with a maturity of 20 years. Eligible bonds must be. terms of which were announced on January The. Treasury took advantage Weekly Bond Buyer's twenty-bond index of municipal bond yields closed at. Year Municipal Bond Indices. Bond Buyer Bond GO Index. S&P Municipal Bond 20 Year High Grade Rate Index. Fidelity GO AA - 20 Yrs. Nyhart recommended. Page. A compilation of different indexes that are widely watched in the municipal bond industry. The Bond Buyer Municipal Bond Index is based on prices for 40 long-term municipal bonds. There are three versions of the index: Version A, which ran from July. In depth view into Bond Buyer Go Bond Municipal Bond Index (DISCONTINUED) including historical data from to , charts and stats. Source: The Bond Buyer. 2-Ja BOND BUYER 20 G.O. BOND INDEX. ( TO. A compilation of different indexes that are widely watched in the municipal bond industry. The following indexes provide an indication of the average weekly. Bond Buyer 20 (20 bond index). Tracks 20 G.O. bonds rated A or better; Published weekly. Bond Buyer 11 (11 bond index). Tracks 11 G.O. bonds rated AA or better. *Bond Principal Redemption Fund $. Net Bonded Debt (including this issue) Bond Buyer's Bond Index % previous week %. Bonds Sold To: (Managing. The Bond Buyer “20 Bond Index” (BBI) shows average yields on a group of municipal bonds that mature in 20 years and have an average rating equivalent to. The Bond Buyer Index is the yield of 20 selected General Obligation bonds rated A or better, all with 20 years to maturity. The other main indexes used are the Bond Buyer 20 Bond Index (also known as the GO 20 Index) and the Treasury Index. There is also an 11 bond index and a

Reintroducing Carbs After Keto Side Effects

Following a very high-fat diet may be challenging to maintain. Some negative side effects of a long-term ketogenic diet have been suggested, including. Atkins recommends adding extra vegetables first and then reintroducing other low-carb foods in the following order: Add a cup or more of your favorite low-carb. Start with 50 grams of carbohydrates per day and work up to 75 or per day. Advertisement. Pay special attention to any bloating, diarrhea, constipation. side effects, and that the name just stuck. It may also refer to the fact that the flowers of many nightshade plants only bloom at night. null. Are Tomatoes. Additionally, when your body cannot digest carbs effectively, hyperinsulinemia or insulin resistance can occur, which leads to increased blood sugar levels over. Since then, the keto diet has been successfully used around the world to And although the Healthy Keto meal plan still keeps net carbs at around However, as with any drastic dietary change, there can be some unwanted side effects. Initial side effects of the keto diet may include brain fog, fatigue. Stick with healthy, organic whole foods whenever possible: Keto or not, you need to eat healthy foods to stay healthy. · Record your macros and increase carbs. Reintroduce carbs to one meal a day gradually. By transitioning in a slow and steady way, you might avoid uncomfortable side effects and reap benefits like. Following a very high-fat diet may be challenging to maintain. Some negative side effects of a long-term ketogenic diet have been suggested, including. Atkins recommends adding extra vegetables first and then reintroducing other low-carb foods in the following order: Add a cup or more of your favorite low-carb. Start with 50 grams of carbohydrates per day and work up to 75 or per day. Advertisement. Pay special attention to any bloating, diarrhea, constipation. side effects, and that the name just stuck. It may also refer to the fact that the flowers of many nightshade plants only bloom at night. null. Are Tomatoes. Additionally, when your body cannot digest carbs effectively, hyperinsulinemia or insulin resistance can occur, which leads to increased blood sugar levels over. Since then, the keto diet has been successfully used around the world to And although the Healthy Keto meal plan still keeps net carbs at around However, as with any drastic dietary change, there can be some unwanted side effects. Initial side effects of the keto diet may include brain fog, fatigue. Stick with healthy, organic whole foods whenever possible: Keto or not, you need to eat healthy foods to stay healthy. · Record your macros and increase carbs. Reintroduce carbs to one meal a day gradually. By transitioning in a slow and steady way, you might avoid uncomfortable side effects and reap benefits like.

reintroducing carbs after an initial period of strict Potential Side Effects: Some people may experience side effects like keto. When you want to call it quits on keto, reintroducing carbohydrates into your life will take some prep work. But do watch out for side effects when your body. You Normally See Better Ends In Individuals Who Limit Their Carb Consumption Additional Try To Maintain Your Carbs As Little As Possible For The Primary Month. Methods: Twenty-five college aged men were divided into a KD or traditional WD from weeks , with a reintroduction of carbohydrates from weeks Most people will see no side effects from introducing carbs. Your body adjusts to that a lot easier than taking them away in most cases. I. Add the carbohydrates in during every other meal. Add in the carbohydrates until you notice some symptoms return. This will usually occur a few hours after. side effects to a minimum with the proper plan of action. I wish that I could have eaten the way I eat and lived the way I live now years. Some negative side effects of a long-term ketogenic diet have been suggested, including increased risk of kidney stones and osteoporosis, and increased. By limiting carbohydrates You may need to adjust your medications after starting a keto diet. Gastrointestinal side effects are also common on the ketogenic. This is usually temporary and will likely disappear after a few weeks without having to come out of ketosis by reintroducing carbs. If bad breath is a. Reintroducing carbs means replenishing glycogen, which, in turn, pulls water back into your muscles. This can lead to a temporary increase in. Those following the low-carb version found it difficult to complete a set of memory-based tasks after just one week following the diet. Link Between Low Carb. after going into ketosis I started reintroduce carbs I tolerate well, such as basmati rice and potatoes and they made the magic. For instance after a carb. Potential side effects (Keto Flu). Despite all the benefits of a Since the Keto diet forbids reintroducing carbohydrates, it is far stricter. side effects to continue on about 10% of the calories from carbohydrates. If And after a month of being instructed, he was following low carb. The. Since carbohydrates are the #1 food source of many gut bacteria, the theory behind low carb, keto diets for gut issues is that you “starve” unhealthy gut. Phases: Some individuals may go through phases, starting with a strict low-carbohydrate intake and gradually reintroducing them over time. How the Keto Diet. If you're trying to follow a strict ketogenic diet, you may experience the 'keto flu' in the first few weeks. This is where you may get side-effects including. Side effects and symptoms of ketosis · Bad breath, also known as ketosis breath · Headache · kidney stone · Nausea · Fatigue · Brain fog · Constipation · Trouble.

2 3 4 5 6